Make sure to limit these costs based on what you can afford according to your budget. Some bills may fall under discretionary spending - for example, monthly entertainment or subscription services.Īfter you’ve allocated money in your budget to your obligations and your long-term financial goals, how much do you have left over? This is what you have available for your entertainment and other discretionary spending. So, take into account your discretionary expenses - the things you spend money on that you don’t absolutely need.Įxamples include going out to eat, buying gifts, taking vacations, purchasing new clothes, and attending movies or shows. Life isn’t just about paying bills and saving money. Step 4: Identify your discretionary expenses. Listing your goals can help you maintain perspective and prioritize your spending as you create your short-term or long-term budget plan. Think about what you want for your personal financial life and set some goals. This is vital because it helps you put a plan in place that prioritizes what’s most important to you.Įxamples of financial goals can include getting out of debt, saving for a down payment on a house, paying off your car, or saving for retirement.

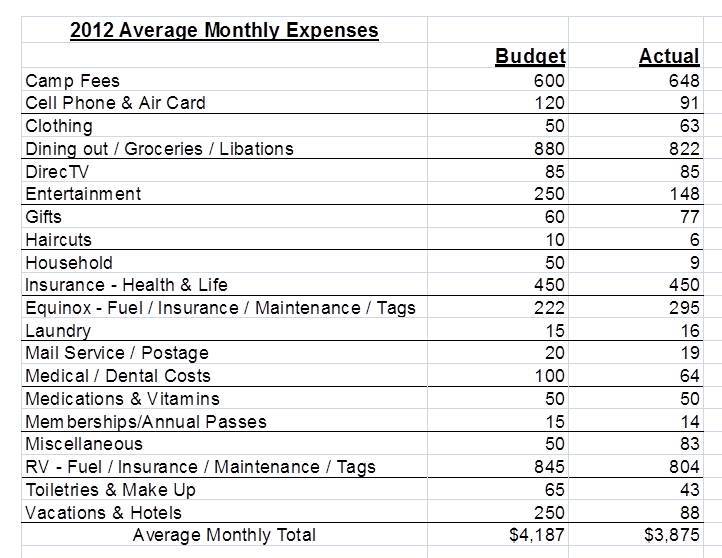

Next, it’s time to establish your financial goals. That will let you know how much money you have left over each month for discretionary spending and financial goals. Then, subtract this number from your monthly income. If the costs for any of these tend to vary, then determine the average cost over the past three months and use that figure.Īdd up the costs of your fixed expenses, and you can see your total monthly financial obligations. Begin by recognizing all of your fixed expenses - the monthly expenses that you absolutely must pay - including things like student loan payments, data, groceries, gas, car payments, insurance, utility bills, and rent. Now that you’ve figured out your monthly income, it’s time to analyze your monthly expenses.

If your earnings aren’t always consistent - for example, if you are a freelancer, or if you work a different number of hours each week - average your income over the previous three months and use that as your baseline. Your monthly income may be simply what you take home from your job. Start by listing all of your sources of income, including things like rental income or money you make from a side job. Step 1: Figure out your income.īefore you start budgeting, you need to know how much money you have to work with. These steps will help get you started with a budget - and ultimately, get more organized. If you’ve never created or maintained a budget before, it might seem intimidating, but it doesn’t need to be. So it’s imperative to maintain a strong, well-considered budget.Īt the personal level, a monthly budget will keep you organized and focused on your personal financial goals. Whether you’re creating a personal budget to get your finances in order, or working with a major accounting firm at a national or global scale, your budget can have implications on every action you take or decision you make. Budgeting is one of the most important aspects of our lives.

0 kommentar(er)

0 kommentar(er)